Capitol Hill is abuzz with excitement over the Waxman-Markey bill, a 932-page document that includes cap-and-trade proposals to reduce carbon dioxide emissions and combat global warming. No doubt, a cap-and-trade scheme will raise the price of energy derived from fossil fuels, lowering demand. But there are many reasons to be skeptical about how effectively cap-and trade schemes will operate.

Cap-and-trade proposals gained political momentum because a similar program helped curb sulfur dioxide emissions from power plants, reducing the magnitude of acid rain. Because there are few natural sources of sulfur dioxide in the atmosphere, it was relatively easy to identify and limit (or "cap") sulfur emissions from power plants. This is not the case for carbon.

Natural sources account for more than 90 percent of the carbon dioxide circulating in and out of the atmosphere each year. In pre-industrial times, sources and sinks were closely balanced. For most of the past 12,000 years, there were few significant changes in the CO2 content of the atmosphere. That came to an end with the Industrial Revolution.

Since the 18th century, a growing human population has steadily increased atmospheric CO2 emissions through burning fossil fuels, such as coal, oil and natural gas. Forest clearing also plays a role in releasing CO2 into the atmosphere. Some emissions, such as those from large coal-fired power plants, will be easy to regulate. Others, such as the release of CO2 from deforestation, are difficult and expensive to quantify.

Most cap-and-trade proposals award carbon credits for those who can capture CO2 from the atmosphere and store it in vegetation and soils. Plants take up carbon very slowly. For this process to make a dent in fossil fuel emissions, very large tracts of land would need to be dedicated to plantings. To put things in perspective, to mitigate 10 percent of the CO2 emissions produced by the United States, trees would need to be planted over an area about the size of Texas.

Once sites are dedicated to carbon capture, there would need to be an effective mechanism to monitor the storage capacity of trees and soils. While the presence of large forests can be tracked using satellites, this technique fails to reveal changes in their carbon content. Tree species differ in their ability to store carbon and many store carbon most effectively during their first 20-50 years of growth. Assessing soil carbon content is even more difficult; one recent study found it would take about 58,000 samples across Europe to estimate a 5 percent change in soil carbon content over a 10-year period.

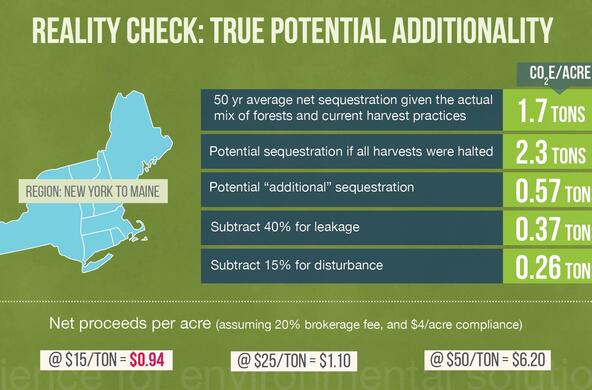

There is no need to compensate forest land owners for allowing existing trees to prosper. The large-scale regrowth of vegetation in the eastern United States began before anyone was interested in climate change. Using tradable carbon credits to reward people for not harvesting certain areas would shift the burden of harvesting to other parts of the world, perhaps overseas to old growth or tropical forests. The atmosphere will show no benefit and pristine ecosystems may be destroyed.

Forest and agricultural soils present another problem for international cap-and-trade programs. Global warming is leading to thawing soils in countries such as Canada and Russia. As frozen soils warm in the higher latitudes, CO2 will be emitted back into the atmosphere. Given the costs, validation difficulties and potential perverse penalties, it would be much easier to ignore forest and agricultural soils in all cap-and-trade programs.

Diverse stakeholders such as Rex Tillerson (CEO of Exxon-Mobil), John Dingell (D-Mich.), Al Gore, and several environmental economists favor a carbon tax over cap-and-trade systems. They realize a tax will raise the price of fossil energy, thereby reducing demand without the complicated schemes, loopholes and bureaucracy of a cap-and-trade program. Ideally, the proceeds from a tax on fossil carbon could be used to reduce traditional income tax—taxing resource use rather than productivity.

If we want to spare our effects on the climate, stimulate investment in alternative energy and reduce dependence on fossil fuels, call the carbon tax a FEE—a fair, efficient and effective way to spread the cost among all users.