In their quest to become carbon neutral, many companies purchase carbon offsets as an alternative to phasing out fossil fuels. Offsets can come from renewables, like wind and solar, or increasingly from natural climate solutions, like forested lands. Forest carbon offsets allow landowners to monetize the carbon being stored by their trees and soils and sell it on the carbon market, where there is high demand.

Over the past decade, forest carbon offsets have emerged as one of the fastest growing finance tools to incentivize forest conservation. Environmental groups, land trusts, and municipalities are involved in deals that sell forest carbon to buyers, including major corporations like Disney, JP Morgan Chase, Delta, and Google. But are these transactions leading to reductions in greenhouse gas emissions?

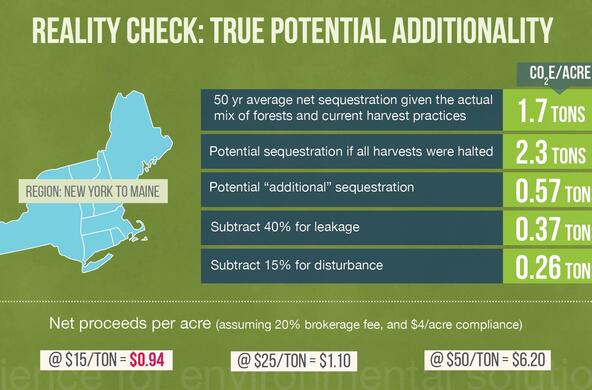

Cary Institute forest ecologist Charles Canham has serious reservations about the true environmental benefit of forest carbon offsets. The way credits are awarded is among his concerns. He explains, “Carbon registries are allowing gross exaggeration of the likely additional carbon storage that would be expected under an offset deal. Markets are extending credits for previously stored carbon that could be liquidated by cutting trees, yet chances of that happening are incredibly slim.”

“There is no plausible path that would lead a land trust, or most forest owners for that matter, to suddenly clear-cut their forests,” Canham stresses. “Yet forest carbon offsets grant corporations the right to emit as much CO2 as if the landowner had done that, in essence assuming the worst-case scenario and letting industry claim offsets based on forest carbon that had been stored over the last 50-100 years, rather than any new and truly additional forest growth.”

The result: landowners with large tracts of forest are being offered significant amounts of money to enter into these agreements. “Individuals, land trusts, and municipalities are all being courted by brokers, with millions of dollars exchanging hands.” And in most cases, Canham warns that credits have little to do with enhancing a forest’s ability to store carbon above ‘business as usual’.

Credits shouldn’t be used to greenwash polluting industries when options like wind and solar present more efficient long-term carbon offset solutions.

Canham notes that reducing or eliminating future harvests is the most common way to bolster carbon sequestration. But this leads to a problem that economists call ‘leakage’. Reducing harvest in one area often simply leads to more logging on other lands.

Adding that, “We have been offshoring our forest products for decades. New York used to have dozens of paper mills. All but a few have moved to places like Malaysia and Borneo, where they rely on plantations of short rotation eucalyptus and pine. If you do the accounting properly, this has likely increased the net flux of carbon to the atmosphere.”

Canham also has environmental justice concerns. Inexpensive forest carbon credits leave little incentive to decarbonize businesses. “Polluting industries can buy forest carbon credits at around ten dollars per ton of emissions and keep spewing pollutants that disproportionately impact disadvantaged communities and communities of color.”

“Our focus should be on helping landowners protect and manage the resilience of their forests so they continue to provide a range of benefits in the face of threats like forest pests and climate change. Credits shouldn’t be used to greenwash polluting industries when options like wind and solar present more effective ways to reduce

carbon emissions.”