Cary Institute forest ecologist Charles Canham, a distinguished senior scientist emeritus at Cary Institute has deep concerns about the true climate benefits of the current forest carbon offset market and discusses the limitations of forest carbon offsets.

In their quest to become net zero, many companies purchase carbon offsets as an alternative to phasing out fossil fuel use. Offsets can come from renewables, like wind and solar, or increasingly from natural climate solutions, like forested lands. Forest carbon offsets allow landowners to monetize the carbon being stored by their trees and soils and sell it on the carbon market, where there is high demand.

Over the past decade, forest carbon offsets have emerged as one of the fastest growing finance tools to incentivize forest conservation. Environmental groups, land trusts, and municipalities are involved in deals that sell forest carbon to buyers, including major corporations like Disney, JP Morgan Chase, Delta, and Google. Millions of dollars are changing hands. But are these transactions leading to reductions in greenhouse gas emissions?

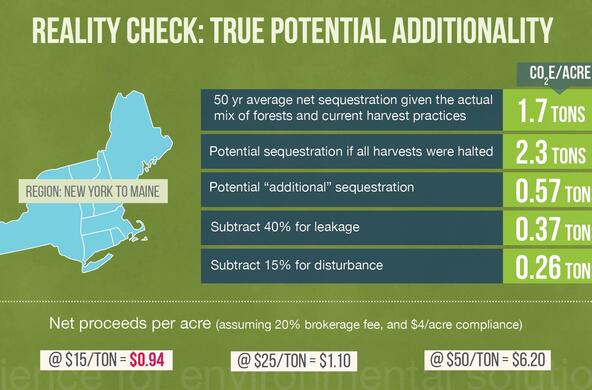

Canham discusses fundamental flaws in how forest carbon offsets are awarded, the folly of granting offsets to already protected lands, and ecological limits on how much carbon US forests can sequester. He will also explore how ‘leakage’ can shift forest harvests to vulnerable locations, and the ethics of allowing industries to purchase credits from faraway forests so they can continue polluting locally.

In Canham’s words, “Flaws in the current forest carbon offset markets are structural and deep, and may be irredeemable.”

Resources

Talk slides: Forest Carbon Offsets: Too Good to be True? (pdf)

Rethinking Forest Carbon Offsets

These Trees Are Not What They Seem, Bloomberg Green

Systematic over-crediting in California’s forest carbon offsets program, Grayson Badgley et al, Global Change Biology

Forests Adrift: Currents Shaping the Future of Northeastern Trees